LLP Corporation: A Comprehensive Guide to Registering a Limited Liability Partnership in India

Starting a new business venture can be exciting and overwhelming. One of the most important decisions you’ll need to make when starting your own business is choosing a legal structure. A limited liability partnership (LLP) is one popular option because it offers the benefits of a partnership while limiting the liability of each partner. An LLP is a unique business venture that consists elements of a partnership as well as a corporation. However, the process of registering as an LLP can be complex and confusing, especially if you’re not familiar with the legal requirements. In this comprehensive guide, we will go through everything you need to know about registering an LLP corporation, from understanding what an LLP is and its advantages to the step-by-step process of registering one. So, if you’re considering setting up an LLP, keep reading to learn more.

What is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership is a kind of business venture that consists of the advantages of a partnership and a corporation. It is a legal entity where the partners have limited liability, which means that their personal assets are protected in case of business debts or legal issues. In an LLP, each partner has an active role in the operations of the business, and they share the profits and losses based on their agreed-upon percentage of ownership. LLPs are particularly beneficial for businesses that require flexibility in management structure and that need to protect the personal assets of their partners. LLPs can be formed for any type of business, from professional services like law firms and accounting firms to creative businesses like advertising agencies and design studios. The registration process for an LLP involves filing the necessary documents with the state government, appointing a registered agent, and obtaining any necessary licenses or permits. It’s important to note that each state has different requirements for registering an LLP, so it’s important to research the specific regulations in your state before starting the process. Overall, an LLP can be a great option for businesses looking for a flexible and protective business structure.

Advantages and Disadvantages of an LLP Corporation

Before deciding whether to register an LLP corporation, it is important to consider its advantages and disadvantages.

Advantages:

- Limited liability protection for all partners: This means that the personal assets of a partner are separate from the debts and obligations of the LLP corporation. If the company experiences financial difficulties, the partners’ personal assets are not at risk.

- Flexibility in management: Unlike a traditional corporation, an LLP corporation allows for flexibility in management. Partners can choose to run the business themselves or appoint a management team

- Tax benefits: LLP corporations are pass-through entities, which means that the business itself does not pay taxes. Instead, profits and losses are taxed on the individual partners’ personal tax returns.

Disadvantages:

- Complexity in formation: The formation process of an LLP corporation can be complex and time-consuming. This includes filing formation documents, obtaining necessary permits and licenses, and drafting a partnership agreement.

- Potential for disputes: Because an LLP corporation is made up of multiple partners, there is potential for disagreements and disputes to arise. It is important to have a clear partnership agreement in place to avoid potential conflicts.

- Limited investment opportunities: Unlike a traditional corporation, an LLP corporation cannot issue stocks or equity to investors. This limits the potential for outside investment.

It is important to carefully consider these advantages and disadvantages before deciding whether an LLP corporation is the right choice for your business.

Who Can Form an LLP?

An LLP is a popular business structure for many business owners, particularly those in the professional services sector, such as lawyers, architects, or accountants. However, any two or more individuals, including individuals from different countries, can form an LLP.

In addition to individuals, corporate bodies, trusts, and even foreign companies can also form an LLP. It is important to note that at least two designated members must be appointed to form an LLP. These designated members are responsible for ensuring that the LLP complies with all legal obligations, such as filing annual accounts and submitting annual returns to Companies House.

It is also important to note that there are certain professions, such as solicitors, where an LLP is the only option for a limited liability structure. This is due to the restrictions on the use of limited companies in these types of professions.

Before forming an LLP, it is important to consider the legal and financial responsibilities that come with it, and to seek professional advice if necessary.

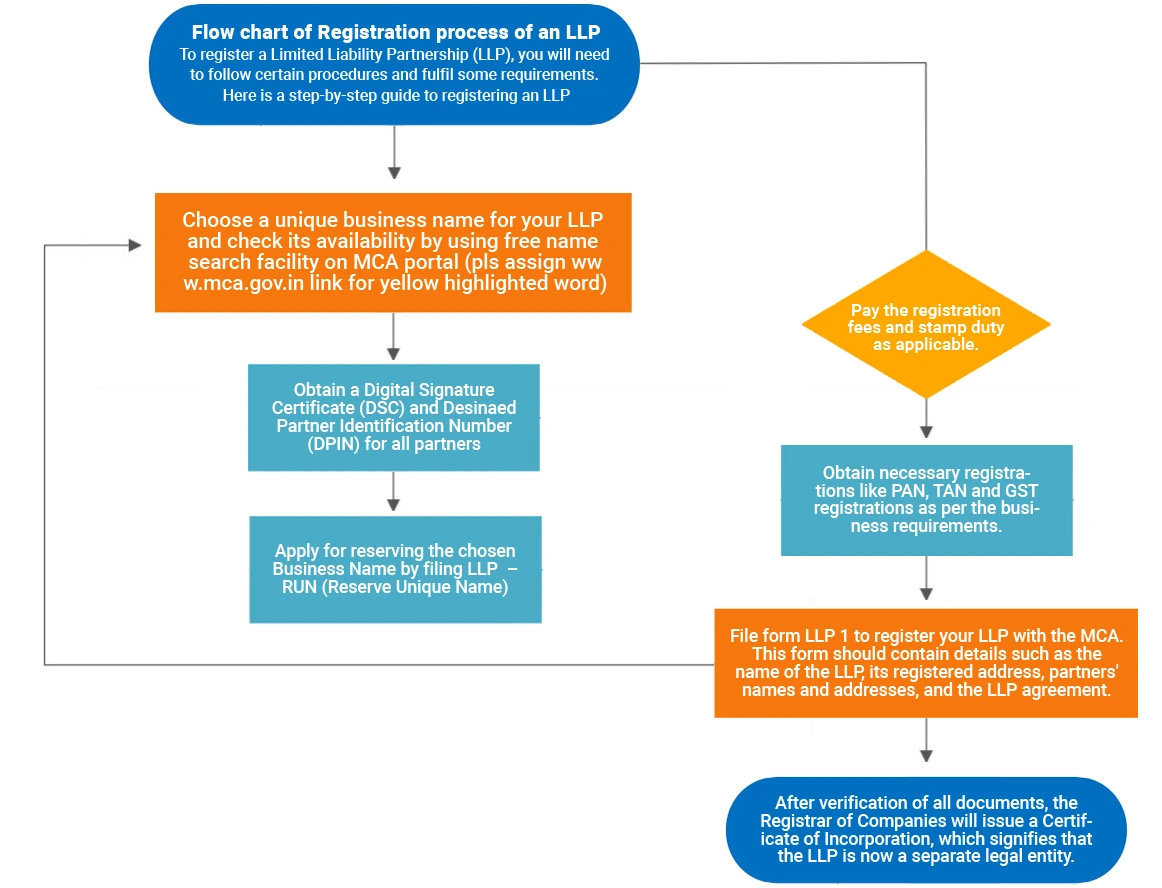

Detailed Steps Involved in Registering an LLP in India

Registering an LLP in India involves several steps that need to be completed in a specific order. The first step is to choose a unique name for your LLP. This name must not be similar to any existing LLP or company name. Once you have chosen an available name, you can apply for reserving the chosen name by filing LLP- RUN with the Registrar of Companies (ROC).

The second step is to obtain a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for all the designated partners of the LLP. DSC is used for signing electronic documents, while DIN is a unique identification number issued by the Ministry of Corporate Affairs for all the directors or partners of a company or LLP.

After obtaining DSC and DIN, you need to prepare the LLP agreement that defines the rights, duties, and obligations of the LLP partners. This agreement needs to be printed on a non-judicial stamp paper and signed by all the designated partners.

Once the LLP agreement is signed, you can file the registration form with the ROC along with the necessary documents. These documents include the LLP agreement, proof of address of the LLP’s registered office, and details of all the designated partners.

After the documents are verified, the ROC will issue a certificate of incorporation, which means that your LLP is now registered and can start its operations. It is important to note that the entire registration process can take anywhere from 15 to 30 days depending on the speed of document processing by the ROC.

Registering an LLP involves several steps that need to be followed in the correct order. It is important to note that the entire process of registering an LLP can be completed online. However, it is recommended to seek professional assistance from a chartered accountant or company secretary to ensure that all legal requirements are met and the process is completed smoothly.

Documents Required for Registration:

Registering a Limited Liability Partnership (LLP) requires specific documents to be submitted to the appropriate governing authority. The documents required may vary depending on the country or state in which you are registering your LLP. However, some of the most common documents required for registration include:

- LLP Agreement: This document outlines the internal workings of your LLP, including the rights and responsibilities of each partner, the profit-sharing ratio, and how the business will be run.

- Proof of Address: This can be a utility bill or bank statement that shows the address of the registered office of the LLP.

- Identity Proof: This can be a passport or driver’s license of all the partners involved in the business.

- PAN Card: The Permanent Account Number (PAN) card is a mandatory document required for all partners of the LLP.

- Digital Signature Certificate: This is required for all designated partners of the LLP and is used to sign and submit the required documents online.

- Certificate of Incorporation: In some cases, if one of the partners is a company or an LLP, a certificate of incorporation or registration for the same will be required.

It’s important to note that the required documents may vary depending on the country or state in which you are registering your LLP. Therefore, it’s always essential to check with the relevant authority to ensure that you have all the necessary documents before submitting your application for registration.

LLP Registration Fees and Timeline

When it comes to registering a Limited Liability Partnership (LLP), it’s important to understand the associated fees and timeline. The fees for registering an LLP can vary depending on the state in which you’re registering. In general, you can expect to pay a registration fee as well as an annual fee to maintain your LLP status.

In addition to the fees, it’s important to consider the timeline for registering an LLP. The process can take weeks or even months, so it’s important to plan accordingly. The timeline for registering an LLP will depend on a variety of factors, including the state in which you’re registering, the complexity of your business structure, and the amount of paperwork involved.

To ensure a smooth registration process, it’s a good idea to work with a qualified business attorney or accountant who can guide you through the process and help you understand the associated fees and timeline. With the right support and guidance of ComplianceBuddy, you can successfully register your LLP and begin operating your business with confidence.

Post-Registration Formalities

Once the Limited Liability Partnership (LLP) is registered with the Registrar of Companies (ROC), it is not the end of the process. There are still some post-registration formalities that need to be taken care of to ensure the smooth running of your LLP.

Firstly, the LLP must apply for a Permanent Account Number (PAN) and Tax Deduction Account Number (TAN). These are essential for filing tax returns and fulfilling compliance requirements.

Secondly, the LLP must also open a bank account in the name of the LLP. This is important to ensure that all financial transactions of the LLP are conducted through this account. The bank account opening process will require the LLP agreement, certificate of incorporation, and PAN and TAN details.

Thirdly, the LLP must also obtain any necessary licenses or permits required for carrying out its business activities. For instance, if the LLP is involved in the sale of alcoholic beverages, it must obtain a liquor license.

Lastly, the LLP must maintain proper books of accounts and file annual returns with the ROC. The LLP agreement must also be reviewed and updated periodically to ensure that it is in line with the changing business requirements.

By completing these post-registration formalities, the LLP can ensure compliance with all applicable laws and regulations and avoid any penalties or legal issues in the future.

LLP Agreement Drafting and Registration:

Once you have decided to form a Limited Liability Partnership (LLP), the next step in the process is to draft an LLP agreement. The agreement sets out the mutual rights and duties of the partners, as well as the rules governing the LLP’s internal affairs. Therefore, it is crucial to ensure that the agreement is drafted carefully, and all partners are satisfied with its contents.

The LLP Agreement should contain essential details such as the name of the LLP, its registered office address, the nature of its business, the rights and duties of the partners, the contribution of each partner, the profit-sharing ratio, and the process for decision-making. It is also important to include provisions on how to deal with disputes among partners and the procedure for admitting new partners.

Once the LLP agreement is drafted, it needs to be registered with the Registrar of Companies (ROC) in the state where the LLP is located. The registration process typically involves filing an application with the ROC, along with the necessary documents such as the LLP agreement, proof of address, and identification documents of the partners. The ROC verifies the documents and issues a Certificate of Incorporation upon successful registration.

It is important to note that the LLP agreement should be reviewed and updated periodically to ensure it remains relevant and reflective of the current state of the business. Any changes to the LLP agreement should also be registered with the ROC to ensure legal compliance. By following these steps, you can ensure that your LLP is registered correctly, and its internal affairs are governed by a well-drafted and comprehensive LLP agreement.

Taxation and Compliance Requirements for an LLP

When it comes to taxation and compliance requirements, an LLP has certain obligations that it must fulfil. For taxation purposes, an LLP is treated as a separate legal entity and is required to file its own tax returns. The partners, however, are not taxed on the profits of the LLP, but rather on their share of the income that they receive as a distribution from the LLP.

As for compliance requirements, an LLP is required to file an annual return with the Registrar of Companies, which includes details of the partners, the registered office address, and the business activities of the LLP. In addition, an LLP is required to maintain proper accounting records and prepare annual financial statements, which must be audited if the LLP’s turnover exceeds a certain threshold.

It’s important to note that failure to comply with these taxation and compliance requirements can result in penalties, fines, or even legal action against the LLP and its partners. Therefore, it’s crucial that an LLP stays up to date with its obligations and seeks professional advice when necessary to ensure compliance.

Conclusion

We hope you found our comprehensive guide to registering a Limited Liability Partnership (LLP) helpful. Registering an LLP is a big decision that requires careful consideration, and we’ve provided you with all the necessary information to make an informed decision. Whether you’re a small business owner, or entrepreneur, an LLP is a great option to protect your personal assets and reduce your liability. Remember to consult with a Chartered Accountant or Company Secretary before making any final decisions, and we wish you the best of luck in starting or growing your business.